P2P Lending Software Development

Build your own P2P lending exchange with advanced and latest features in the market with experts.

P2P Lending Platform Development

In the new era of digitalization, the online transactions and the utilization of cryptocurrency is increasing in a high pace day by day. With many countries adopting the cryptocurrency, here is huge demand for crypto exchanges and lending platforms also. The decentralized and easy worldwide transaction the platform offers attracts many users into the trend. The P2P lending platforms settles all crypto trades immediately with smart contract based transactions that are seamless and trouble free without any third party intervention.

P2P Lending Exchange Development

As a top rated cryptocurrency exchange development company, we assure to provide the most secured and efficient p2p lending platform that will bring out instant benefits for your business. Our team of experts assures to provide a customizable and scalable lending platform by keeping the market advancements and client satisfaction in the mind.

Advanced P2P Lending Platforms

P2P Crypto Lending

We equip the system with the latest features in the market to provide a peer-to-peer crypto lending for easy worldwide trade.

P2P Fiat Lending

We help you free yourself from the disadvantageous of the traditional lending methods with decentralized and trouble free P2P fiat lending platform development.

P2P Cross Lending Platform

We assure advanced and new in the market lending options with innovative fiat and cryptocurrency cross lending network for seamless lending.

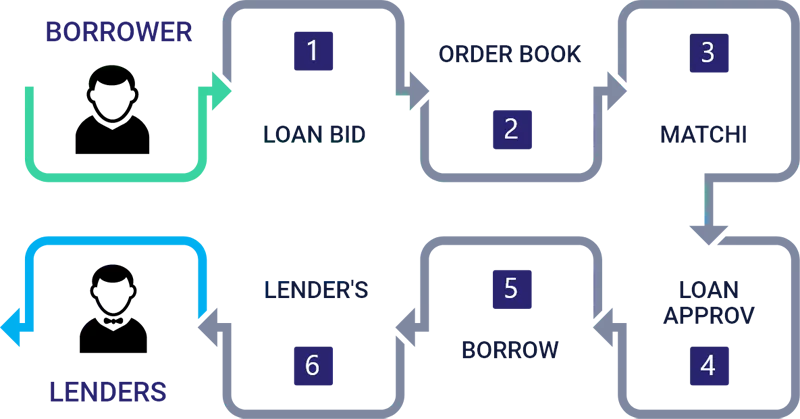

How P2P Lending Software Works?

1

User Registration – The lender and the borrower has to create an account in the platform with their identity verified (KYC\AML)

2

Borrow request- The borrower can now send requests to the lenders with their profile information and documents.

3

Lender confirmation- The lender can check the borrower’s details and proceed with the process.

4

Matching engine- The platform helps the borrowers and the lenders to find the relevant users accordingly with the conditions specified b y them.

5

Direct communication- The lender and the borrower can interact directly to know if their ideas and conditions match to complete the request.

6

Loan interest- The smart contract figures out the loan interest based on the financial status and commitments.

7

Lender confirms the payment – Once all the conditions are fixed, the lender confirms the payment.

8

Auto repayment- The borrower has to pay to the installment according to the smart contract. Penalty is deducted from the borrower if the user fails to pay and the collaterals are sold in the market if the payments are undone.

Robust Features Of Our P2P Crypto Lending Platforms

Multi-Layer Security

Completely secured P2P cryptocurrency lending platform with two or multi factor authentication for logging in.

KYC And AML

Reliable location based user identity verification options like KYC and AML to eliminate hackers and unauthorized activities.

Escrow System

Highly secured and smart contract based escrow system for automated transactions including locking and releasing the funds.

Hot Wallet

Protected and multicurrency hot wallets allows seamless, simple cryptocurrency transactions at a very high speed.

Loan Calculator

Detailed equated Monthly Installment (EMI) calculated to have troublefree and tested lending options.

Credit Score

Reviews and credit scores to choose the best borrower or the lender to know the users financial commitments.

Loan Origination Process

Easy and seamless loan origination process in the Peer-to-Peer lending platform with utmost reliability.

Auto-Renewal Of Loans

Automatically renew the loans without manual errors and any third party intervention in adding lending orders in the order book.

Advanced DashBoard

View the overall data of the amount transferred to the borrowers, repayments and the balance in the wallets of any user in case of an issue.

No Third-Party Beneficiaries

Facilitate intuitive smart contracts to ensure automated and secured transactions without any middlemen.

Smart Contracts

Predefined guidelines and robust smart contracts that eliminate manual errors and third party involvement.

Decentralized

Ensured privacy to the user’s identity and also security to the credentials makes the platform trustworthy.

Terms & Conditions

Create your own terms and conditions before you start the lending service to get borrowers who accept your requirements.

Refinance Management

Facilitate new loans from another lender to refinance him to complete the installments in the given period of time.

Loan Valuation Ratio

Hassle free transactions with LVR calculator that will help the lender to access and make decisions for the loan application.

Loan Feedback

Approve the borrow requests only after check the feedbacks given to the user regarding the timely repayment of the loans and installments.

Lender Management

Allow the lenders to get the recommendations of profiles of borrowers based on the provided conditions and lending capacity.

Lending Limits

Set the lending limits based on the income and tax of the user to check the eligibility for the amount requested by the borrower.

Document Management

Check out the profile of the borrower or the user’s documents and feedbacks easily before moving forward to the lending process.

Lead Management

Assistance for lenders to create and manage leads, repayment statuses, amount distributed, balance, user documents for easy lending.

Borrower Management

Assistance for the borrowers to submit borrow requests with documents regarding the eligibility and repayment commitments.

Latest Security Features In The P2P Lending Software

Data Encryption

We offer high security to the data, credentials stored in the database and privacy of the users with encryption feature.

JWT Encryption

Our platform is completely protected from data manipulation with RSA encryption in JSON Web token.

Anti-Denial Of Service (DoS)

Our platform is guarded from outpouring requests from the attackers and offers troublefree trade.

Anti-Distributed Denial Of Service

The experts here provide security against cyber like DDOS attacks that make the network unavailable for users.

SQL Injection Protected

Our platform is safe from malicious outputs from hackers or unauthorized activities.

Prevent Self-XSS

We ensure supreme protection from illegal accesses of user accounts and any breach.

Server-Side Request Forgery

Our expert developers offer complete security to the users from vulnerable servers.

HTTP Parameter Pollution

The platform is safe from any HTTP request of hidden information access in the network.

Login Forgery

The platform helps the user secured from any fraudulent activity and check on multiple user logins.

Why Shamla Tech For P2p Lending Platform Development

As a top peer to peer lending platform development company, we assure that all the services we provide are highly advanced with the top most and trending features in the market. Our developers are the best in providing the most reliable P2p lending software for all your business needs.

Data Dashboard

- User information

- Active users

- Escrow account

- Balance of all cryptocurrencies

- Total loans and EMI

Borrowing Management

- Total Borrowed

- Total Deposited

- Total withdrew

- Lending and Borrowing Orders

Lending Management

- Finance KPI

- Lending KPI

- Fees System

- Repayments

Real-Time Reporting

- Lending report

- Credit rating report

- Pending transactions

- Balance in wallet

- Profit report

FAQ

What is peer-to-peer lending?

Peer-to-peer lending is a very easy and trustworthy alternative to traditional methods of lending and borrowing processes. Here unlike usual methods of centralized administrative authority like banks and other intermediaries the users can get the loan amount from the lenders.

Is the P2P lending platform safe for lending?

The platform is absolutely safe as the smart contacts ensure completely secured transactions.

What are the advantages of P2P lending?

A P2P lending exchange is provides huge benefits including superfast transactions, topnotch security, privacy and seamless trade. The platform is completely trustworthy and reliable as it eliminates third party involvement.