Attract Influential Investors With Regulated Verifications

Identify dynamic opportunities with

Identity verification solutions.

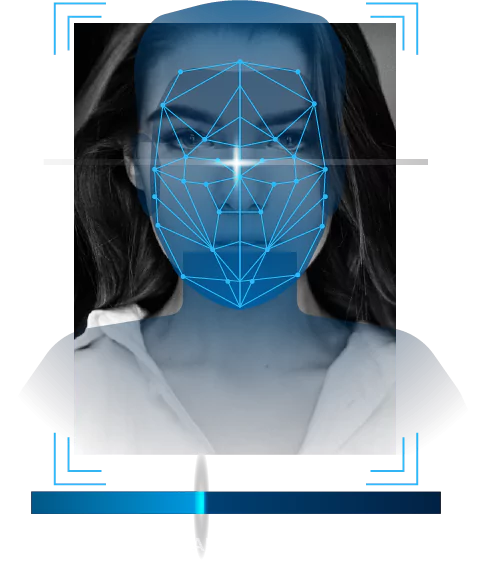

Verify Customer Online From Anywhere

Knowing your customer mitigates fraud, risk and financial crime

Real Time

Global

Reliable

What Is KYC?

KYC process helps to ensure that the financial services are not misused. The feature has a very important meaning in the business world in order to verify the identity of their clients either before or during the time that they start doing business with them. KYC Verification Services can also regulate the transactional practices by verifying clients’ identities.

What Is AML?

AML acquires the safety rules to help detect and report suspicious activity leading to money laundering. Anti-Money Laundering Services seeks to deter fraudsters by making it harder for them to hide the deception. The safety regulations and rules ensure strong security and seamless trade by attracting appropriate investors and avoiding hacker’s intervention.

Why It Is So Important For You Today?

With the increase in fraud and identity theft, it has become a necessity for ICOs, banking institutions, credit companies, and insurance agencies to require their customer’s detailed information in order to make sure that no corruption, bribery, terrorism funding, money laundering and other illegal activities are involved.

Regulatory Compliance

Enable financial institutions to comply with tough regulations to avoid risk and fraudulent activities.

Enhanced Reliability

Earnest customers ensure higher order credibility which increases the trustworthiness of the project.

Risk Elimination

Know the customers who are genuinely interested in your ICO to attract only authentic investors.

Legitimate Funding

KYC combined with AML services will provide a transparent system for transactions accounting for legalised trade.

How Our Expertise Can Help You?

KYC for your ICO or token offering requires an experienced team to reach the actual goal. As one of the top KYC AML solution providers, our expert team assure to get everything in order before you launch, and promise to protect yourself and your customers from being caught up in a money-laundering scheme with precise regulations and build the community’s trust towards your project.

- In-depth assessment and strategies including consulting, outsourcing, client outreach and end to end services.

- Best fit for your project to gain potential customers leading to easy and fast start of your ICO.

- Security and data privacy compliance trustworthy trade and satisfactory investors.

- Use of latest and advanced technologies for reliability and meet industry trends.

- Legal expertise in the field to cut risks associated from identity theft and financial fraud.

- High Scalability and customisability for easy adaption with the new developments.

Data screening

Get definite customer risk, AML Screening Solutions and payments assessment processes that help identify the elements of harm.

Search set-up

End to end online identity verification service for transactions, money laundering, threats and politically exposed persons (PEPs) for safety.

API

Incorporate our cutting edge and proficient functionalities to attain relevant screening and KYC compliance services.

Authentication Solutions For KYC

- Proof of Identity: Passport, PAN Card, Voter’s Identity Card, Driving License

- Photo proof: Liveliness detection, Compared to provided ID

- Proof of Address: Bank/credit card, bank statement or a utility bill

AML Monitoring

- Financial Action Task Force (FATF) standards

- Identify suspicious behaviour or illegal activities

- Transaction Monitoring

- Determine risks and complications (like PEPs)

Our Features And Benefits

High Reliability

We assure well reasoned guidelines for easy, precise and valid research accounting for complete reliability.

Objective expertise

Our team of expert digital KYC service providers holds the competence to analyse the subject matter and provide accurate documentation.

Information updation

We monitor media sources, regulatory and enforcement lists round the clock and hand over up-to-the-minute data.

Targeted search

We provide refined and filtered screening to identify high risk factors and avoid false identity recognition.

Detailed search

We ensure to search and enable the detection of unapparent risk population and liable networks.

Simple integration

We help easy and seamless integration to get into the screening processes in no time and achieve fast results.

A Global Marketplace For Identity Solution

AML Watchlist Check

Id Document Verification

Global Passport Verification

Automated Identity Verification

Business Verification

Industries

Ecommerce

Blockchain

Telecommunication

Finance

Why Choose Us?

KYC AML service provider Shamla tech with the help of World-Check provides information that profiles entities and individuals around the world, easing the due diligence audit processes for the business community.

Extensive search

Our digital KYC solution includes far-flung search results against millions of records to identify every risk factor.

Precise screen

We provide greater screening against specific lists or data sets, or specific fields within those data sets, like gender, nationality and date of birth.

False positive omission

Our search algorithms and filtering technology helps to minimize the false positive results to the most.

Efficient teamwork

We define customized workflow with expert teams focussed on investigations and promoting speed and efficiency.

Consolidated screening

Our KYC verification services provide operational efficiency for on-boarding, Know Your Customer and third-party risk due diligence.

Audit and report

We assure detailed reports that can be used as part of management reporting and a regulatory proof in case of audit.

AI monitoring

We enable artificial intelligence (AI) to help effective navigation of media reports relevant to the data for KYC compliance solutions.

Easy scaling

Our KYC and AML compliance software are built to be easy adaptable for the all businesses and customisable for customer’s respective needs.

Risk intelligence

We provide public domain data, connections between individuals, business or family to uncover networks that can pose a threat.

Identify PEPs and associates

We target and point out PEP category and other sub-categorized risk-based screening that comes under the risk policy.